Sell Now or Wait? Salt Lake Valley Market Update 2025

🏡 Salt Lake Valley Market Check (Aug 2025):

More Inventory Is Cooling Price Growth—But “Patient” Sellers Are Sitting Out, Keeping Prices Sticky

Homeowners across Herriman, South Jordan, Riverton, and the broader Salt Lake Valley are asking the same question: “If inventory is up, why aren’t prices dropping faster?” Short answer: inventory has risen and price growth has slowed, but a growing share of would-be sellers are waiting for better conditions (or pulling listings), which keeps overall supply tighter than it looks—and supports prices.

What the data says (local + national)

-

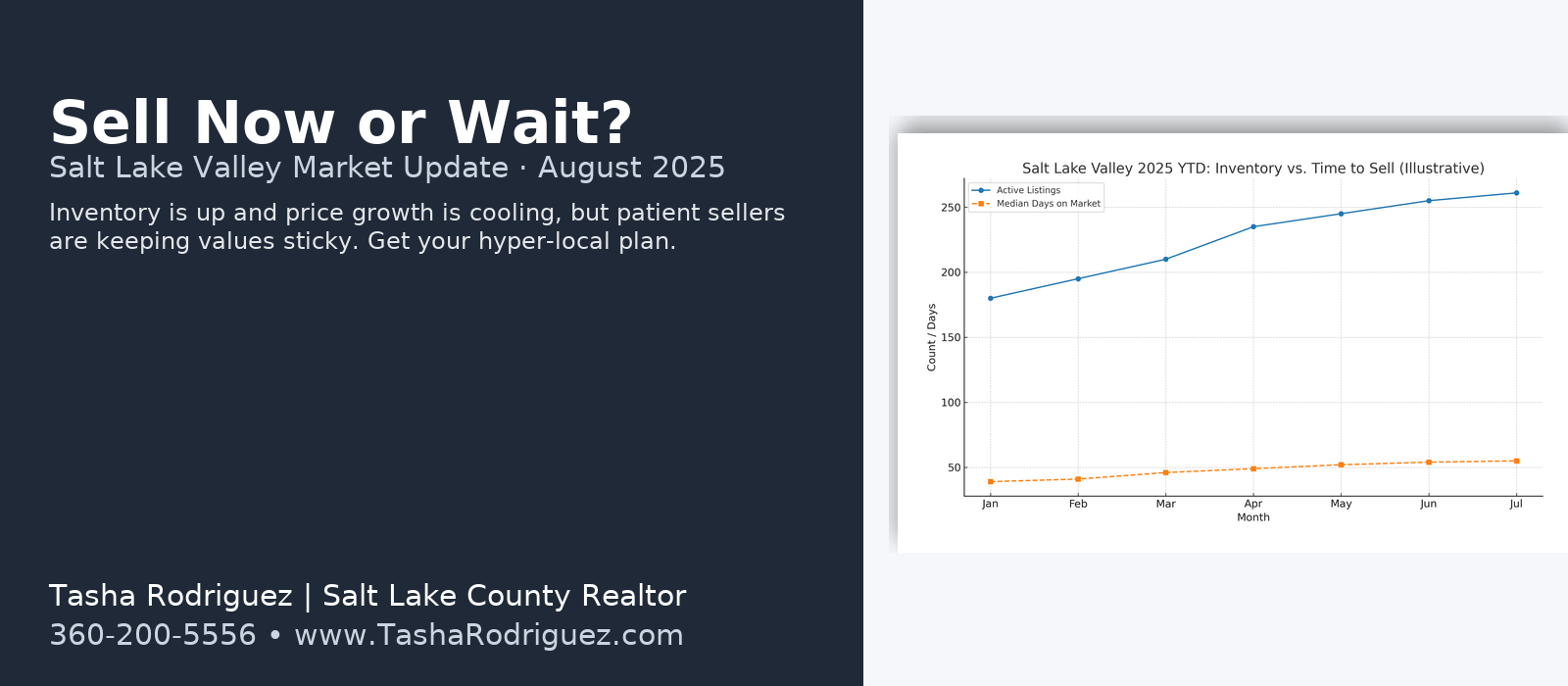

Utah inventory is up: Active listings climbed sharply year over year heading into 2025 (UtahRealEstate.com data reported by KSL). That increase helped ease the frenzy and gave buyers more choice. KSL

-

Price growth has moderated, days-on-market longer: This spring brought more available homes, longer time on market, and more moderate price increases—with many sellers offering concessions to get deals done. The Salt Lake Tribune

-

Utah/Wasatch Front trend, early summer: June indicators show inventory up ~26% year over year, Days on Market ~54, and a modest +2% median price—classic signs of cooling, not crashing. ucaor.com

-

Salt Lake City snapshot: Realtor.com reports median days on market ~55 (buyers have more time), while Redfin shows prices varying by neighborhood and month. Translation: micro-markets matter—your city, school boundary, and price tier can move very differently. RealtorRedfin

-

Why prices aren’t falling faster: Two supply brakes are at work:

-

The rate “lock-in” effect: Most owners still have mortgages below today’s rates, which keeps many on the sidelines. Even as lock-in slowly eases, it’s still a major reason supply isn’t flooding the market. RedfinRealtor

What this means if you’re considering selling in the Salt Lake Valley

Pros right now

-

Less bidding-war fatigue, more serious buyers: Buyers have time, but they’re focused—and they act on well-priced, move-in-ready homes. The Salt Lake Tribune

-

Sticky prices in many segments because some sellers are waiting/delisting rather than cutting deeply. Realtor

-

Equity remains strong after several years of gains; even with slower growth, many sellers can still capture excellent outcomes. KSLucaor.com

Cons to plan for

-

Longer average market times if you overshoot on price or skip preparation (median DOM in our area is roughly 4–8 weeks, and longer for dated homes). Realtorucaor.com

-

More negotiation: Concessions (rate buydowns, closing costs) are common again—plan your net, not just your list price. The Salt Lake Tribune

Pricing + timing: why your block matters more than the headlines

In 2025, micro-markets drive outcomes: a turnkey 4-bed in Herriman with a finished basement and EV-ready garage is a different market than a dated split-level near a busy road. With months of supply hovering around balanced in parts of the Wasatch Front, condition and strategy decide whether you sell in 2–3 weeks or 60+ days. utcollective.com

My recommendation (as your local pro)

-

Price to the moment, not last year. Use current actives + under-contracts within 0.5–1.0 miles—not just closed sales from 90 days ago.

-

Win on presentation. Small pre-list fixes (paint, lighting, hardware) + a pre-inspection can cut DOM and boost your net.

-

Model multiple paths:

-

“List now” scenario: expected DOM, likely concession range, and net.

-

“Wait 60–90 days” scenario: impact if rates/inventory shift.

-

-

Decide with real data from the Realtor side of WFMLS (reports the public can’t access): absorption by price band, days to offer, list-to-sale ratios, and concession prevalence for your micro-market.

Thinking about selling this fall? Let’s get you a real number.

I’ll build you a hyper-local Pricing & Timing Brief that includes:

-

WFMLS absorption + DOM trend for your price tier

-

Active/pendings you’re competing against right now

-

Likely concession range and net under 2–3 pricing strategies

Call/Text: 385-503-3224

Website: www.TashaRodriguez.com

Prefer email? I’ve got you covered: I’ll send the brief as a PDF same-day.

Categories

Recent Posts

GET MORE INFORMATION